2025 Geek Gauge CCAAS Ranking/Report

(Sponsored by the Advice from a Call Center Geek Podcast)

Why We Created This Report

The contact center space is evolving at lightning speed, especially when it comes to AI. With so much noise and constant change, it’s increasingly difficult to keep track of who’s doing what.

This isn’t about picking winners. It’s about giving you an honest look at where each platform stands today, based on real, up-to-date information pulled from AI.

Some platforms are built for massive scale. Others prioritize speed, simplicity, or deep integrations. Some specialize in outbound operations. Every platform brings unique strengths depending on your goals.

Inside, you'll find a structured, transparent snapshot of the CCaaS landscape as it stands right now. Whether you're in the middle of vendor selection, planning for AI adoption, or simply benchmarking your current tools, this report is designed to be your starting point.

How This Report Was Built

We approached this project with one central question:

If Chat GPT was an analyst, how would it evaluate today’s CCaaS platforms?

Using a combination of ChatGPT, the ChatGPT Deep Research Tool, and the ChatGPT Operator Tool, we conducted a structured, unbiased evaluation across 19 leading providers.

Our Research Process

ChatGPT synthesized thousands of pages of documentation, pricing models, product updates, and customer insights.

ChatGPT Deep Research Tool extracted structured insights from over 20 trusted analyst reports, including Gartner, Forrester, and Metrigy.

ChatGPT Operator Tool organized, scored, and verified every finding against public sources.

A Report Built on Structured, Real-Time Research

This isn’t a compilation of personal opinions or vendor pitches. It’s a structured, fact-based analysis of 19 of the most widely used and forward-thinking CCaaS platforms.

We didn’t rely on gut checks or surface-level impressions. Instead, we used AI-driven research to dive deep into each platform. Our sources included:

- Official product documentation

- Public pricing and packaging pages

- Product update logs and roadmaps

- Customer support portals and knowledge bases

- Trusted review platforms like G2, TrustRadius, and Capterra

- Analyst reports including Gartner Magic Quadrant, Forrester Wave, and Metrigy research

- Company blogs, demo videos, customer testimonials, and recent news coverage

All insights were verified with publicly available data as of April 2025. If a vendor added generative AI in March, we captured it. If pricing models changed, it’s reflected here.

The goal: no assumptions. No spin. Just facts.

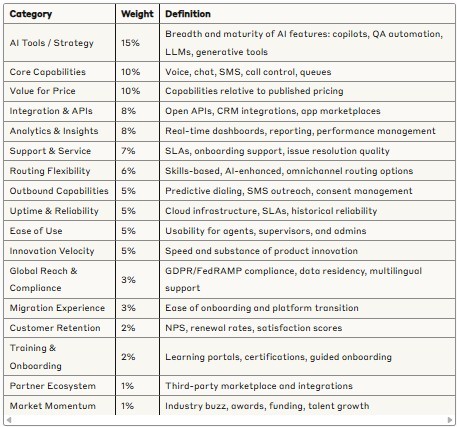

Every platform was evaluated across 17 weighted criteria, with an emphasis on what matters most today, especially around AI capabilities.

We’re not trying to replace the amazing work done by Gartner, Forrester, or Metrigy. Our goal is to add a fresh, real-time lens to the conversation, one grounded in today's rapidly changing market conditions.

Why This Report Matters

In a world flooded with marketing promises, contact center leaders need clear, structured insights they can actually use. This report bridges the gap—helping you:

- Select a new platform

- Benchmark your current tech stack

- Stay ahead of the shifting CCaaS market

Some platforms are built for enterprise-scale AI deployments. Others are better suited for fast-growing, mid-sized centers. Every platform brings different strengths, and the right choice depends on your specific goals, resources, and vision for the future.

What follows is a balanced, research-backed view of the CCaaS landscape—focused on what’s happening right now.

The 17 Evaluation Criteria and Their Weightings

Each platform was evaluated against 17 key categories, with weightings that reflect modern contact center priorities:

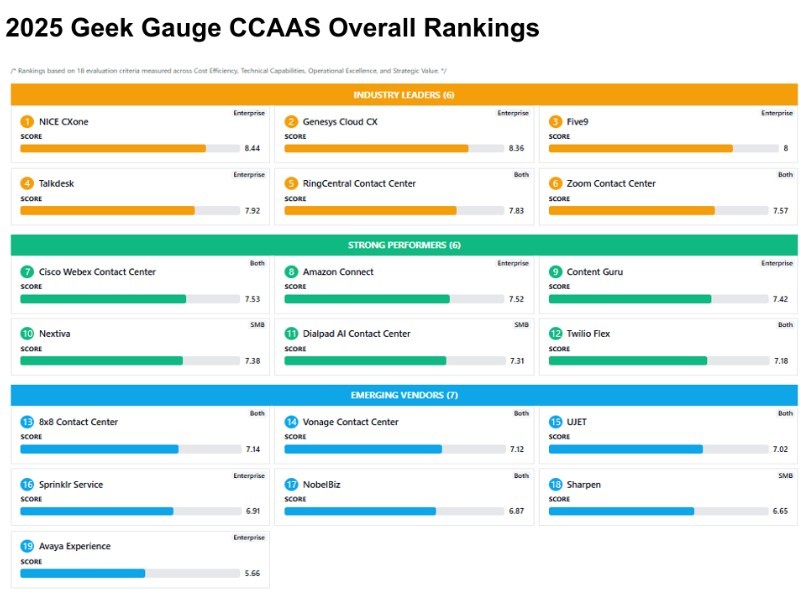

2025 Geek Gauge CCAAS Overall Rankings

CCaaS Platform Rankings based on 18 evaluation criteria across Cost Efficiency, Technical Capabilities, Operational Excellence, and Strategic Value

The ranking above presents a comprehensive view of today's CCaaS market, organized into three distinct tiers:

The "Industry Leaders" category features established platforms like NICE CXone, Genesys, and Five9 scoring above 8.0, with particular strength in enterprise deployments.

The "Strong Performers" group includes specialized players like Cisco Webex and Amazon Connect, alongside flexible solutions like Twilio Flex serving both enterprise and mid-market segments.

The "Emerging Vendors" represent platforms with focused strengths and unique value propositions, though their overall capabilities score slightly lower across our combined criteria.

Each platform was evaluated using the same 17 criteria, with special emphasis on AI capabilities, integration depth, and operational scalability, reflecting the priorities of modern contact centers. Many platforms effectively serve both enterprise and SMB markets, while others demonstrate clear strengths in specific segments.

AI is reshaping the contact center. Here's where the top 19 CCaaS platforms stand today.

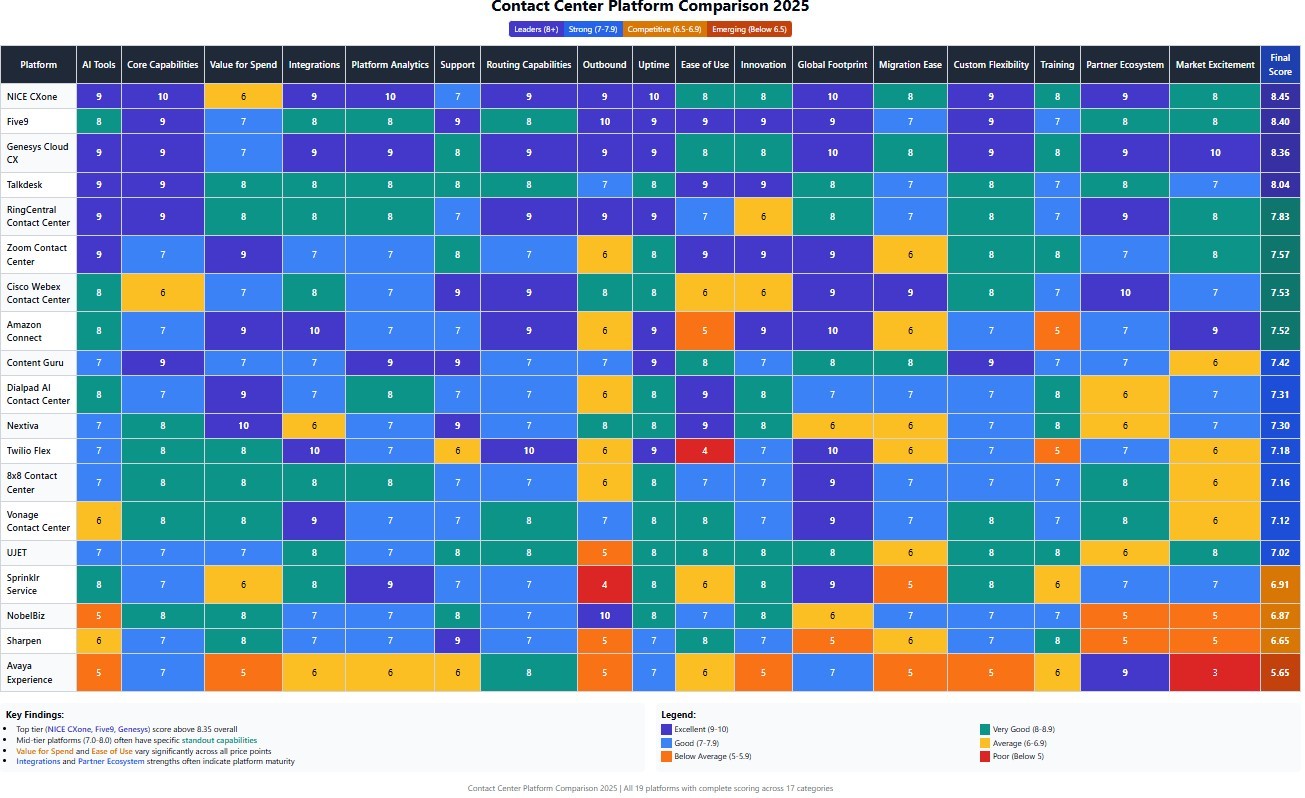

Deep Analysis: 2025 Contact Center Platform Comparison Grid

This visual matrix provides a detailed, side-by-side comparison of 19 major CCaaS platforms across

17 weighted evaluation categories. Each vendor was scored based on structured, AI-driven research, with a final normalized score to benchmark overall platform strength.

Key Observations

1. Clear Market Leaders Emerge

The top three platforms, NICE CXone (8.45), Five9 (8.40), and Genesys Cloud CX (8.36) distinctly separate themselves from the rest of the field.

They consistently score in the "Excellent" range (9-10) across critical dimensions like AI Tools, Core Capabilities, Routing, Outbound, Platform Analytics, and Global Footprint.

- NICE CXone leads slightly on AI Tools, Platform Analytics, and Global Reach.

- Five9 and Genesys Cloud CX are nearly tied, reflecting strong overall execution but slightly different strengths (Five9 a touch stronger in Outbound, Genesys slightly stronger in Innovation and Market Excitement).

Takeaway: These three platforms represent the safest bets for enterprises prioritizing scalability, advanced AI adoption, global support, and strong outbound campaign capabilities.

2. Second Tier: Very Strong Mid-Market and Crossover Options

Talkdesk (8.04) and RingCentral Contact Center (7.83) sit just below the leaders. Both show:

- Excellent Core Capabilities, Routing, and Outbound support

- Good but not leading Innovation and Global Expansion

- Some minor gaps around Migration Ease and Training resources

Zoom Contact Center (7.57) is notable for high Ease of Use, although its Outbound strength is more moderate compared to the top-tier players.

Takeaway: These platforms are strong choices for organizations balancing cost, flexibility, and functionality, especially those looking for robust core operations and a reasonable outbound suite without full enterprise complexity.

3. Strong Mid-Pack Performers

A cluster of platforms falls into the "strong performer" range (7.0–7.5 final scores):

- Cisco Webex Contact Center (7.53): Excellent in Support and Partner Ecosystem but moderate in Outbound and Core Capabilities.

- Amazon Connect (7.52): Very strong in Analytics and Uptime, but notably weaker in Outbound (6/10), reflecting a focus on inbound and self-service.

- Content Guru (7.42): Well-rounded across most categories but lacks leadership in AI or Outbound.

- Dialpad AI Contact Center (7.31): Good AI tools and Voice capabilities, but Outbound only moderate.

- Nextiva (7.30): Competitive Value for Spend but limited in Global Reach and Outbound power.

Takeaway: These vendors are strong options for specific scenarios, especially for companies needing inbound and omnichannel strength without heavy outbound demands.

4. Emerging Vendors Facing Competitive Pressure

Vendors scoring below 7.0 highlight important areas of weakness:

- Twilio Flex (7.18): Excels in Custom Flexibility and Integration but underperforms in Outbound (6/10).

- 8x8 Contact Center (7.16): Solid Core Capabilities, but lacking in Migration Ease and Partner Ecosystem depth.

- UJET (7.12): Innovation-focused, but trailing in Ease of Use and outbound execution.

- Sprinklr Service (7.02): Good Platform Analytics but gaps in Outbound and Migration support.

- NobelBiz (6.87), Sharpen (6.81), and Avaya Experience (5.65) stand out for specific use cases.

Takeaway: These platforms may serve niche use cases but require careful vetting if outbound campaign management, AI innovation, or migration flexibility are priorities.

Strongest Outbound Platforms

A standout subset of platforms consistently demonstrated excellent outbound capabilities, including predictive dialing, SMS campaign management, and proactive customer outreach:

Key Takeaways:

- NobelBiz emerges as an Outbound Specialist, scoring a perfect 10. While NobelBiz struggles in broader platform capabilities (AI, analytics, integrations), it delivers exceptional strength for organizations whose operations are heavily outbound-focused (e.g., collections, sales, appointment setting).

- Five9 maintains its reputation as the outbound market leader for larger enterprise-grade deployments.

- NICE CXone and Genesys Cloud CX offer powerful outbound capabilities paired with deeper AI ecosystems, making them ideal for blended inbound/outbound environments.

- Talkdesk and RingCentral Contact Center provide strong outbound functionality, especially for mid-market buyers seeking more cost-effective or flexible solutions.

Additional Patterns and Insights

- Value for Spend vs. Capability Tradeoffs: Platforms like Nextiva and Content Guru offer strong pricing and basic features but cannot match the AI or outbound depth of leaders yet.

- Ease of Use Gap: Platforms such as Zoom, Dialpad, and UJET offer agent-friendly designs, but enterprises need to verify backend migration and outbound capabilities carefully.

- AI Differentiation is Accelerating: NICE, Genesys, and Five9 show meaningful separation on AI maturity. Mid-tier platforms are improving but remain 1-2 years behind in AI innovation cycles.

- Innovation Velocity Disparities: Twilio Flex, Amazon Connect, and Dialpad show strong roadmaps, while older legacy providers (Avaya, NobelBiz) are struggling to keep pace.

Summary

The 2025 Geek Gauge comparison highlights a market of widening gaps:

- Top players are combining AI excellence with outbound strength and global reach.

- Mid-tier options can deliver great value but require trade-offs depending on priorities.

- Emerging vendors must close gaps around outbound operations, AI integration, and innovation speed to stay competitive.

For contact center decision-makers, choosing the right platform in 2025 isn’t about "checking boxes, it’s about aligning your selection with your AI strategy, outbound needs, and innovation speed.